Treasury bonds are quickly becoming a hot topic in Kenya. As the nation gradually shifts its investment focus beyond real estate and the long-cherished “buroti maguta maguta”—those 50x100ft plots that many older Kenyans have long considered the gold standard—bonds are entering the conversation.

However, along with the growing interest in bonds comes a wave of misinformation, often driven by aggressive salespeople eager to earn a commission by onboarding you.

In this article, we aim to clear the air, offering an unbiased explanation of how government bonds really work, while also highlighting their potential downsides—something seldom discussed.

Above all, we discuss three methods through which you can begin trading in government bonds i.e. The Dhow CSD method, the USSD code method and the Investment Bank method. Should you need more personalized support on this topic, one of the experts at Bizsasa might be able to help.

Ready to learn? Let’s dive in.

Looking to Invest Your Money?

See what our experts think are the best business ideas in Kenya currently.

Benefits of Treasury Bonds

- Bond interest rates tend to keep up or even outperform the inflation rate, making them ideal for preserving your purchasing power.

- Competitive interest rates (at least that’s the case in Kenya currently)

- A good way to diversify your investment portfolio.

- You can choose to compound your bond by re-investing the coupons in other available bonds.

- In some cases, it’s possible to take a loan against your bond amount.

- Treasury bonds are government-backed, hence low risk of default.

Disadvantages of Bonds

- Bond prices may fluctuate as dictated by the laws of demand & supply

- Offloading bonds can be quite a process especially if done before maturity (in the secondary market)

- Some types of bonds are taxable meaning you lose part of your earnings to the taxman

- Bonds are paper assets meaning their value depends on the existence of a stable government, should there be chaos and the government goes the Somalia or Haiti way (God forbid), bonds would lose their value…that’s unlike commodities like gold or real estate which are real assets that tend to hold their intrinsic value even in crises.

How to Buy Kenya Treasury Bonds Online – The Dhow CSD Method

Long gone are the days when you needed to make a physical visit to the CBK and complete lengthy paperwork to purchase bonds. These days, it is possible to do all that conveniently either using a computer or smartphone. Here’s how thanks, to Dhow CSD, a platform owned by the Government of Kenya through the Central Bank of Kenya. This digital trading platform was launched on September 2023 by His Excellency President William Ruto. As of June 2024, the platform was reported to have over 80000 active users.

Just so you know, the name ‘Dhow’ is derived from those old ships that were used for coastal trading while CSD is short for ‘Central Securities Depository.’

Here’s how to sign up for an account.

Requirements

- Applicant must be at least 18 years of age

- Access to the internet

- Smart device i.e., phone or computer

- Registered phone number

Step 1: Visit the Portal

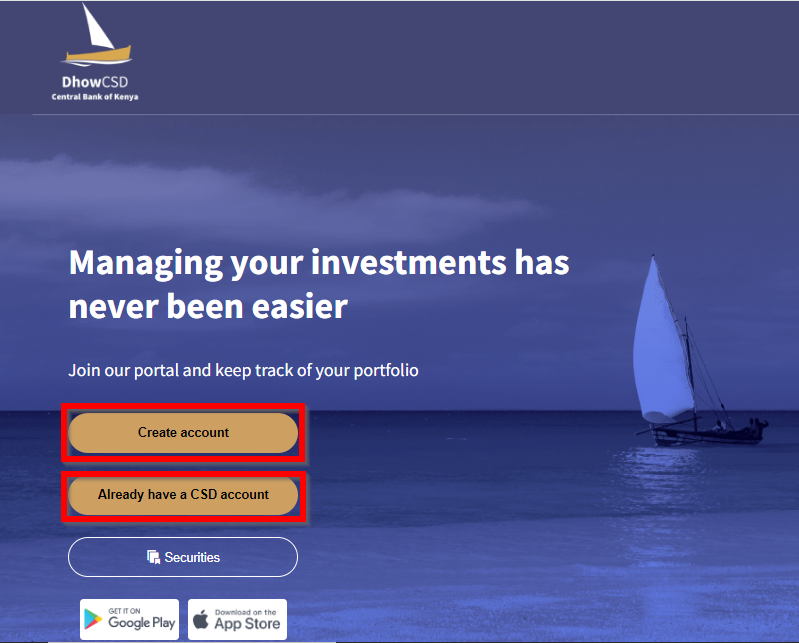

You simply need to visit the Dhow CSD Portal or Download the App. If you already have an existing account (i.e., if you have been trading with the CBK before), simply click on the tab written ‘Already Have a CSD Account’. You will be prompted to fill in your email address so the system can send you an OTP through which you can access and activate your account

To learn how to place your first treasury bond bids, scroll down the section in this article titled “How to Place Treasury Bond Bids Online”.

However, if this is your very first time trading with the CBK in recent years, you will need to register by clicking ‘Create Account’ and then proceeding to “Step 2” below.

Step 2: Fill The Required Details

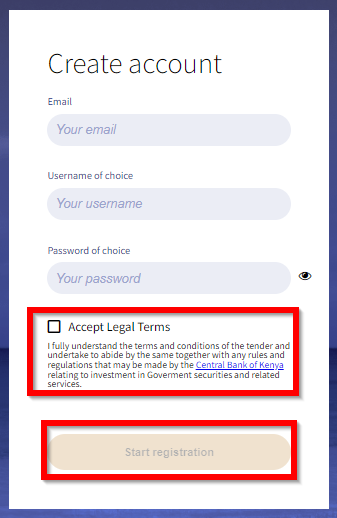

After you click on “Create Account”, you will be required to fill in your email address, your preferred username, and also your password of choice. You also have to accept the legal terms before you proceed. To continue click on “Start Registration.”

Step 3: Proceed with your Registration

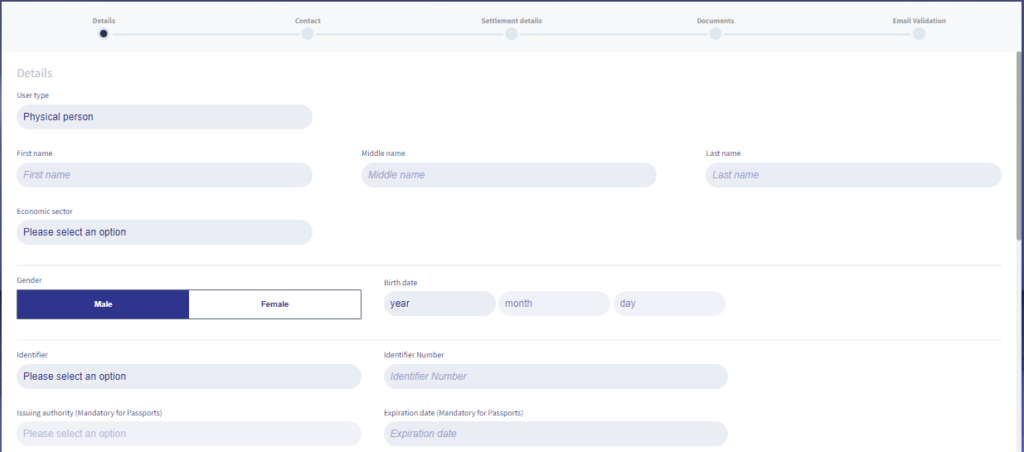

Here a form pops-up whereby you are required to fill in your personal information. This includes your name, economic sector, gender, birth date, identifier and identifier’s number.

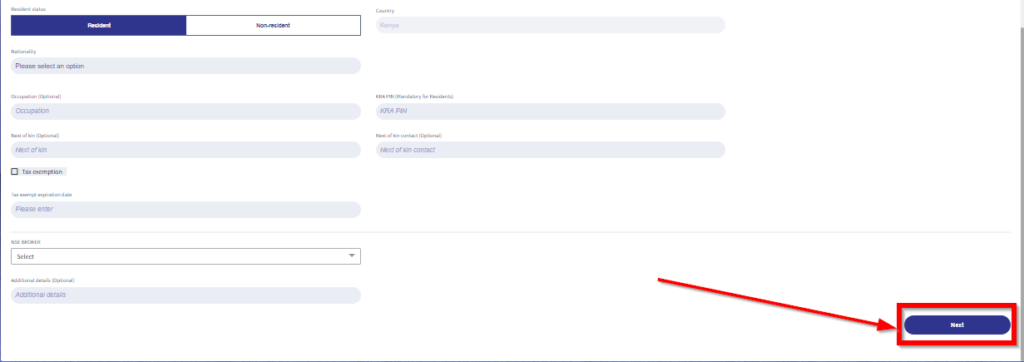

On the same page, you are required to fill in your residency status, country, nationality, occupation (optional KRA Pin (optional, tax exemption expiration date, NSE broker, and also additional details. After you ensure that all the details are correctly filled click on ‘Next’ to proceed.

Step 4: Fill in the Contact Details

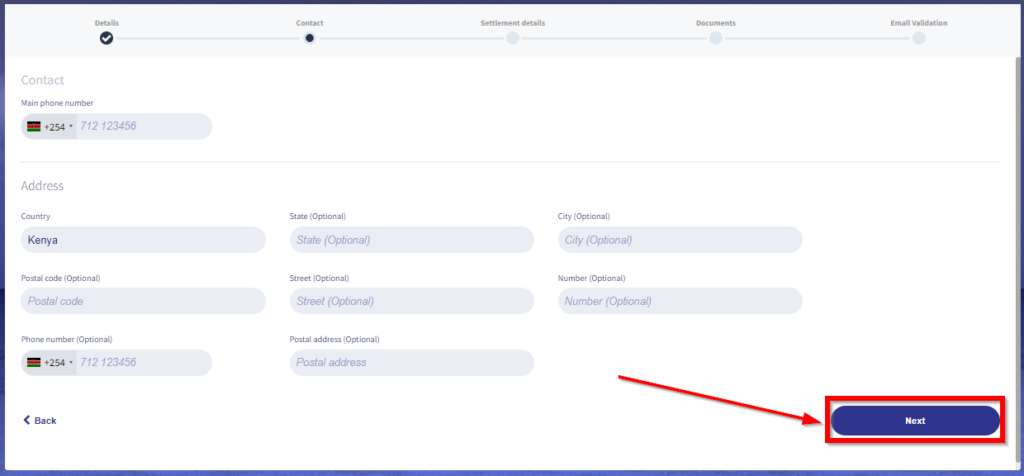

The next step is to fill in your contact details notably your main phone number as well as your country of residence. Other details like State, City, Postal Address etc. are optional.

When done click “Next’.

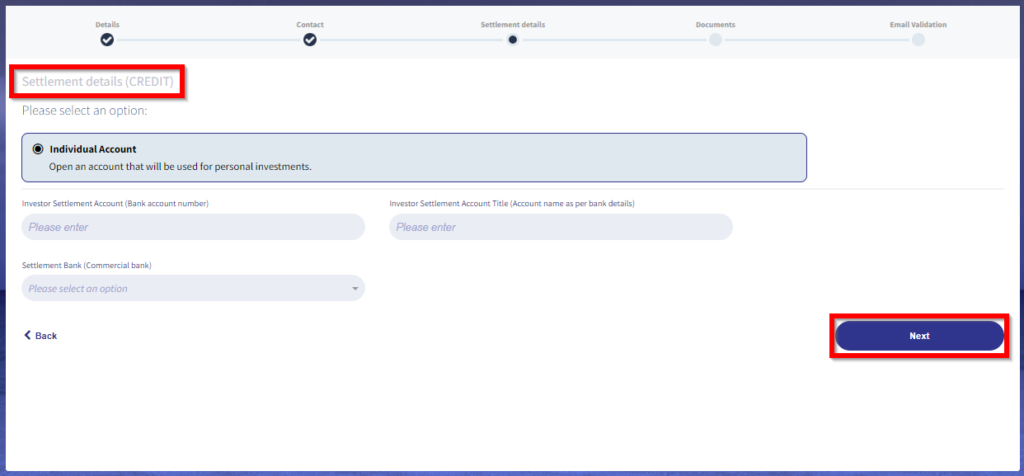

Step 5: Fill in your Settlement Details

You will fill in your bank account number, the name as per the bank details, and the bank involved in the settlement.

Once again to proceed you will click on ‘Next.’

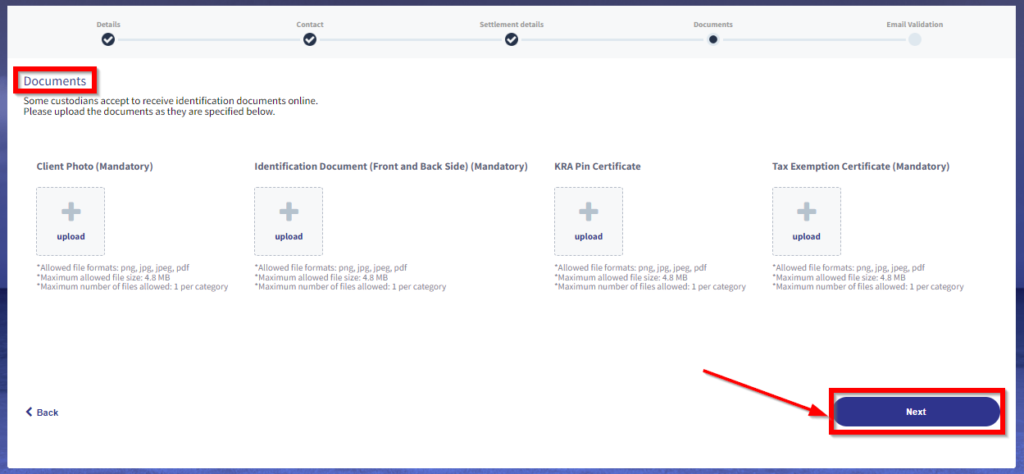

Step 6: Upload the Necessary Documents

The documents to be uploaded under this step are: your photo; your identification document; your KRA Pin Certificate; and also, the Tax Exemption Certificate.

To proceed click on ‘Next’.

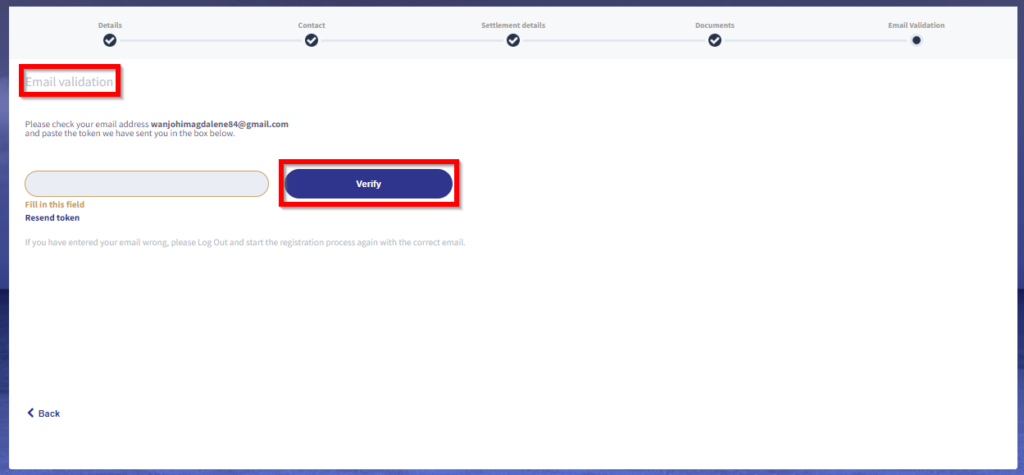

Step 7: Email Validation

Here you will check your email address that you filled in whereby a code was sent and you will paste it in the box provided under this page. You will then click on ‘Verify’.

After you click on ‘Verify’ an email is sent informing you that your profile creation has been submitted and that another email will be sent to you within 48 hours once your Dhow CSD account has been approved.

How To Place Treasury Bond Bids Online

First of all, you need to understand that Treasury bonds are auctioned on a monthly basis but a variety are dished regularly throughout the year so what you need to do is keep looking out for upcoming auctions.

Before placing your bid on any bond, you need to first assess your interests, risk appetite, and how long you intend to hold the bond etc.

It is also important to note that the bonds made available include:

- Fixed coupon treasury bonds whose interest rates do not change so their interest payments remain constant (but come with 15% Withholding Tax)

- Infrastructural bonds whose returns are high since they are tax exempt.

- Zero coupon bonds are similar to Treasury bills and they are sold at a discount hence they have no interest payments.

- Savings development bonds which are basically long-dated fixed coupon bonds meant to build a saving culture among investors

How to Bid for Bonds via Dhow CSD

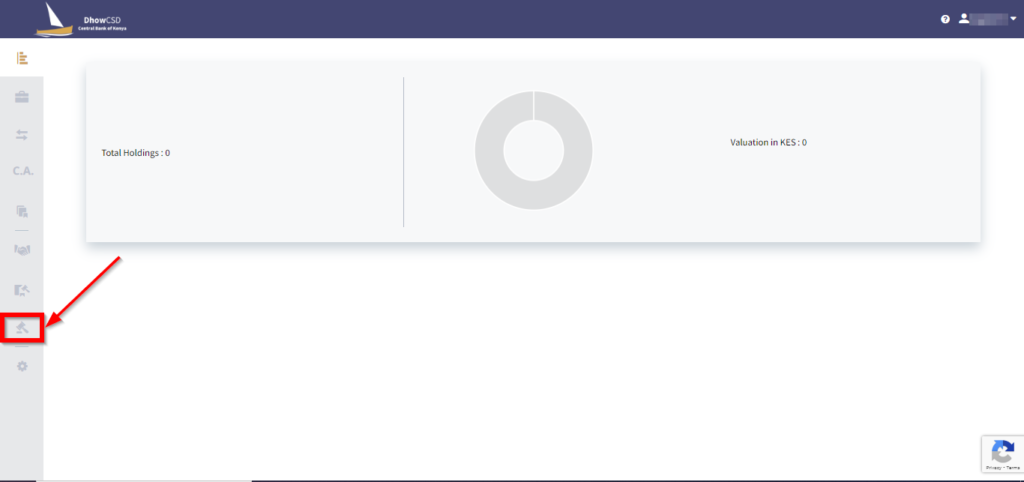

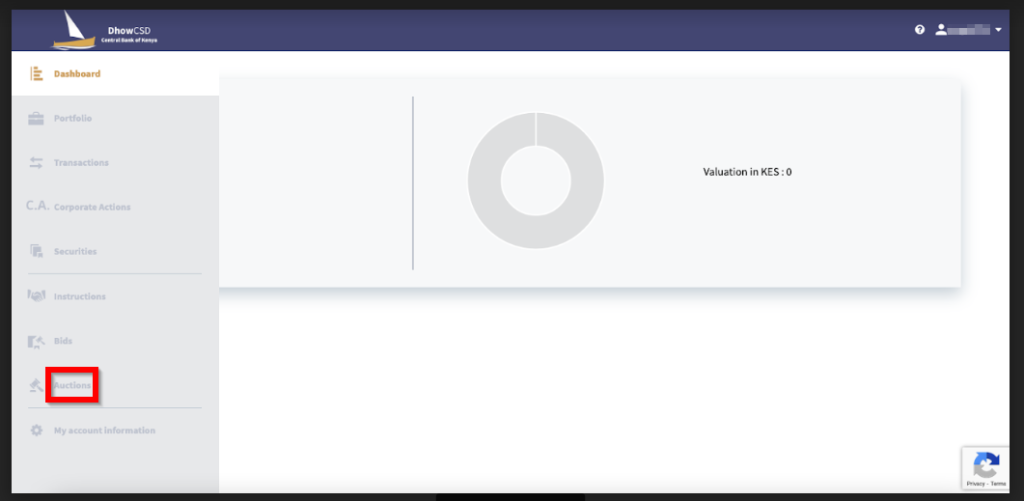

- Log in to your account on the DhowCSD website or App to access your dashboard.

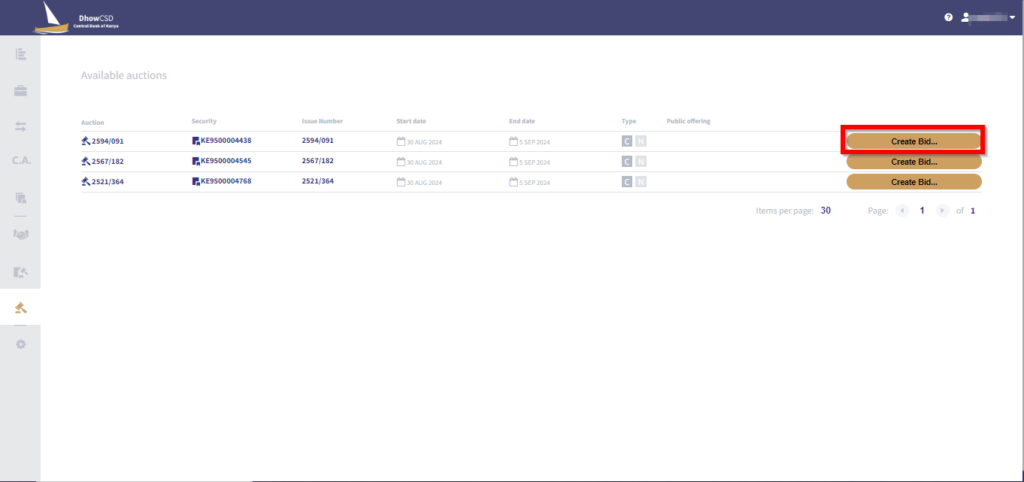

- On the menu list to your left, click on “Auctions” and a list of securities available for auction will be provided there.

- Once you make up your mind on the specific bond you’d like to invest in, simple click on the goldish button adjacent to the bond that reads ‘Create Bid’.

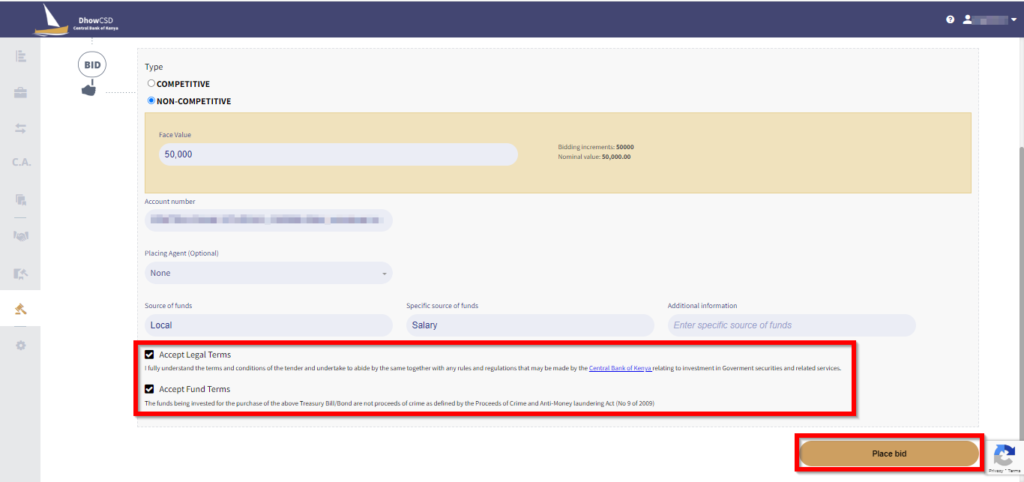

- Bids can either be competitive or non-competitive. The competitive option is meant for those investing over Ksh2,000,000.00 and are looking to specify the yield rate they’d like to receive from the CBK. Most retail investors will be just fine with the non-competitive option which allows the CBK to dictate the interest rate.

- Fill the ‘Face Value’ field with the amounts you intend to invest. This should be in multiples of Ksh50,000 only i.e., Ksh50,000, Ksh100,000, Ksh150,000 and so forth.

- Make sure your correct CBK account is displayed in the ‘Account Number’ field and also (optional) choose the Placing Agent. If you’re a solo investor, leave this as “None”.

- Select the ‘Source of funds’ which can either be local or offshore.

- Under the ‘Specified Source of Funds’, select the applicable one to you i.e., ‘Maturing T-Bill/T-Bond’ or ‘Others’ or Salary’.

- Accept the ‘Legal’ and ‘Fund’ terms and click “Place bid” and confirm this action once again via the second window that pops up.

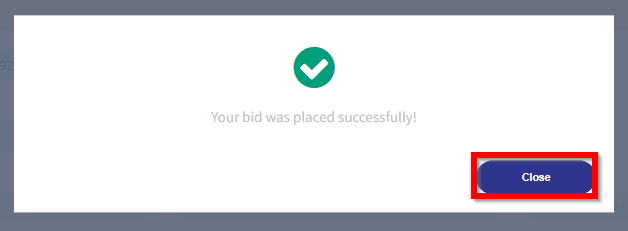

- Finally, a new window will pop up confirming that you have successfully placed the bid. You’ll also receive an email on the same.

- Once your bid is approved, another email will be sent to you with further instructions especially concerning the amount you need to wire to the CBK.

How to Cancel Bond Bids on Dhow CSD

If you would like to cancel a bid that you had placed earlier, simply click on the ‘Bids’ menu and a list of submitted bids will appear.

- Select the bid that you want to cancel, and click on the tab written ’Cancel Bid’.

- The ‘Bids’ menu will now display the bid status as “Canceled”.

Payment for Successful Bids

Payment should be made by 2 pm on the settlement date via RTGS. If the settlement date is a public holiday, you will have to opt for the next business day.

You will need to provide the details below for each payment:

- Beneficiary Name – Your full name as used in your DhowCSD account

- CSD Account No – Available under the Settings>Profile Info>Accounts in DhowCSD

- Reference Number (Payment Key) – Typically sent to you on the approval email you get when your bond is approved.

- Amount Payable – The amount you filled during bid placement.

- Swift Code – For those in the diaspora looking to wire funds to the CBK in Kenya your bank will need you to provide this info.

| Swift Code | CBKEKENX |

| Bank | Central Bank of Kenya |

| Branch | Central Bank of Kenya |

| Address | HAILE SELASSIE AVENUE |

| Branch Code | NDO |

Purchasing Treasury Bonds via USSD Code a.k.a Treasury Mobile Direct (TMD)

You can also purchase Kenyan treasury bonds using the USSD code *866#. Simply dial that code and follow the prompts to register an account if you don’t have one already. However, your phone needs to be using a Kenyan telephone network (i.e., Safaricom, Airtel etc.) for this to work. Once your account is up and running, these are the steps to follow to place your bond bids:

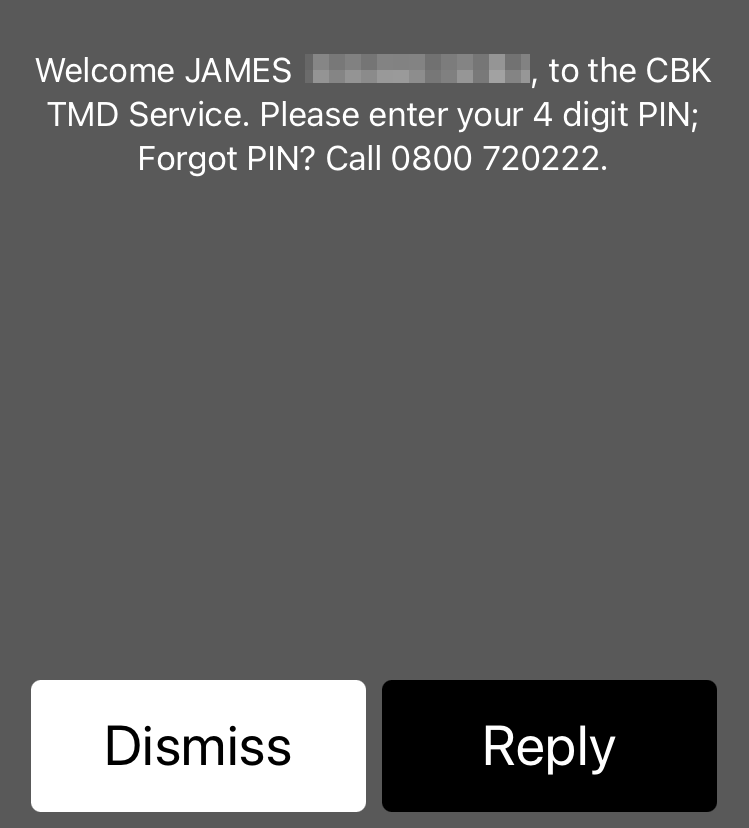

Step 1: Dial *866# and login to your account using your unique PIN

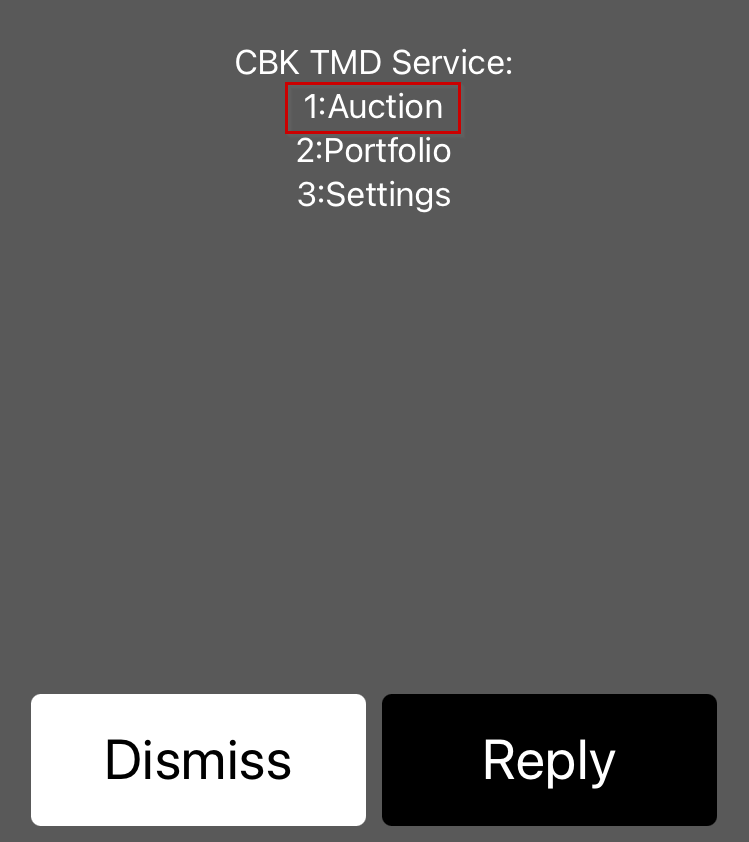

Step 2: Select “Auction’ to view the securities available in the market

Step 3: Select the CSD account you intend to use for this trade

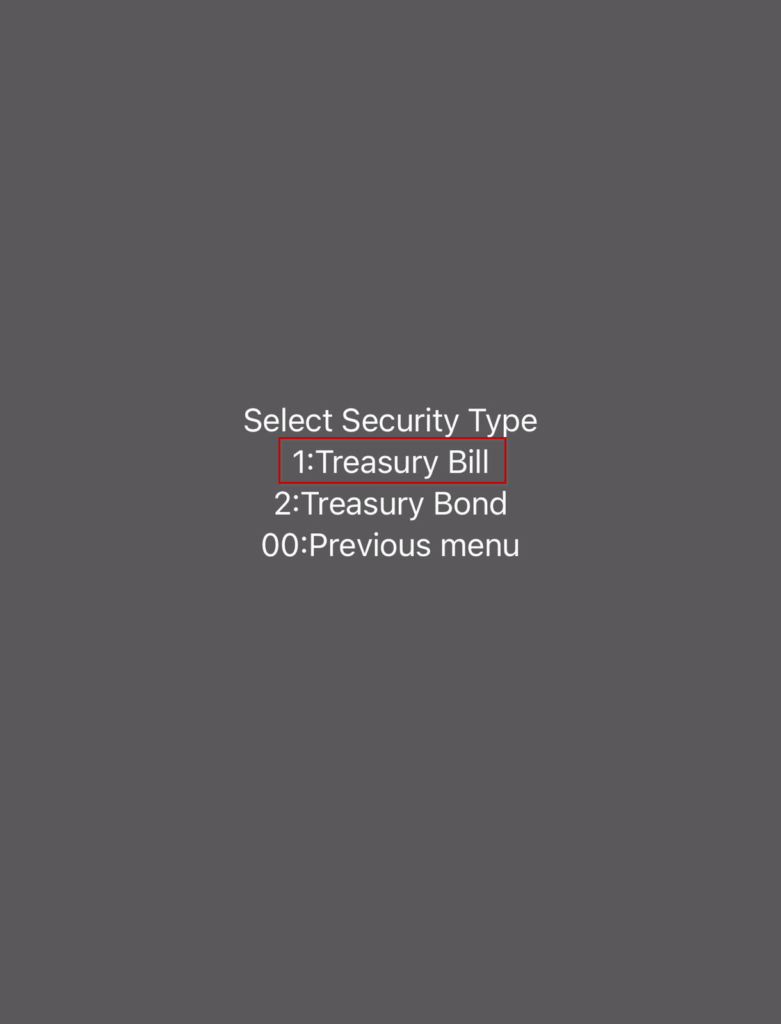

Step 4: Select “Security Type”, in this case you go with option 2 which is “Treasury Bond”

Step 5: A list of bonds available for auction will be availed to you, select the one you prefer

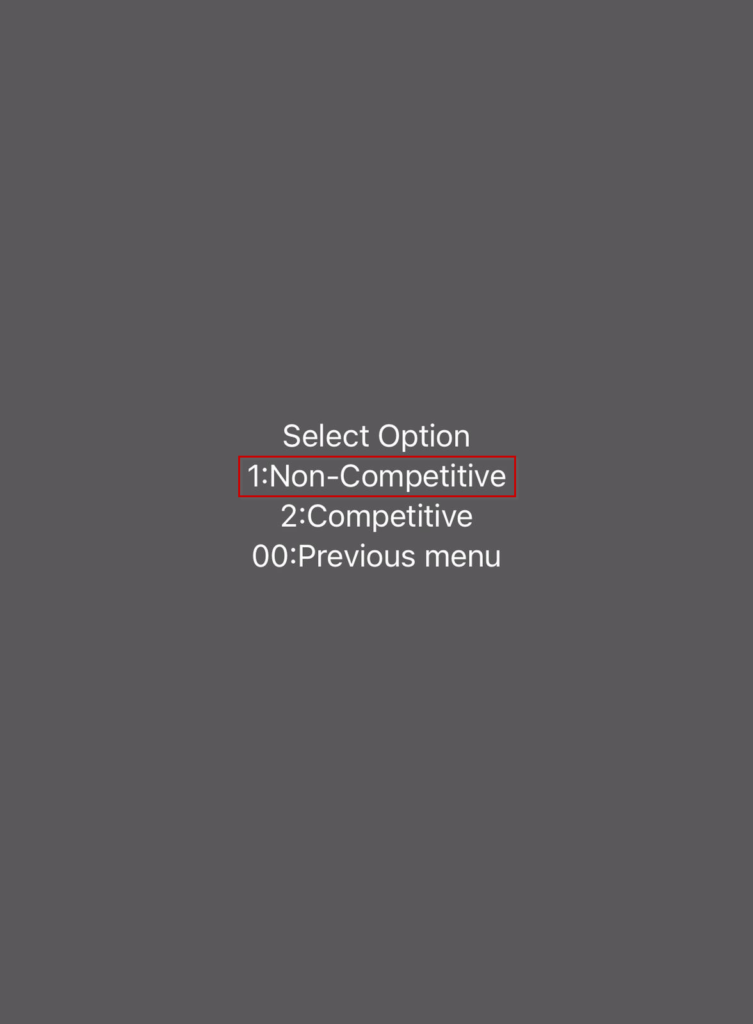

Step 6: Under “Competitive” and “Non-Competitive” select Non-Competitive if you are a small-scale retail trader. Big, institutional traders may choose the Competitive option.

Step 7: Input the bid amount i.e., the amount you intend to invest in that particular bond, this should be in multiples of Ksh50,000 i.e., 50,000, 100,000, 150,000 and so forth.

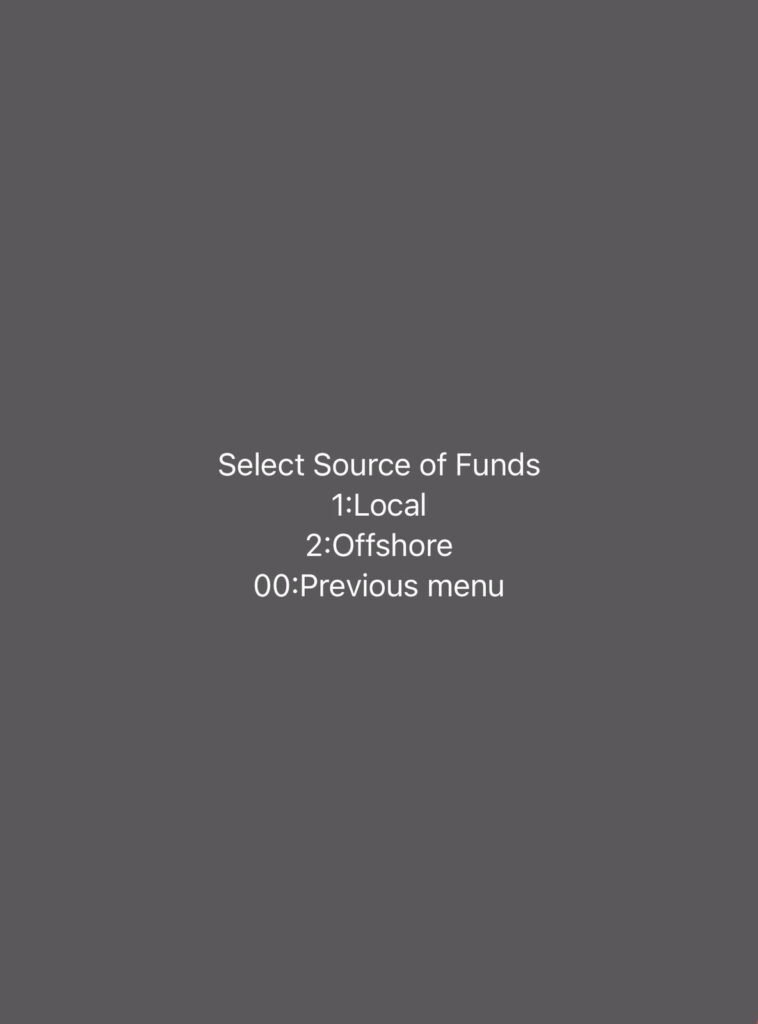

Step 8: Declare your source of funds and specify the same

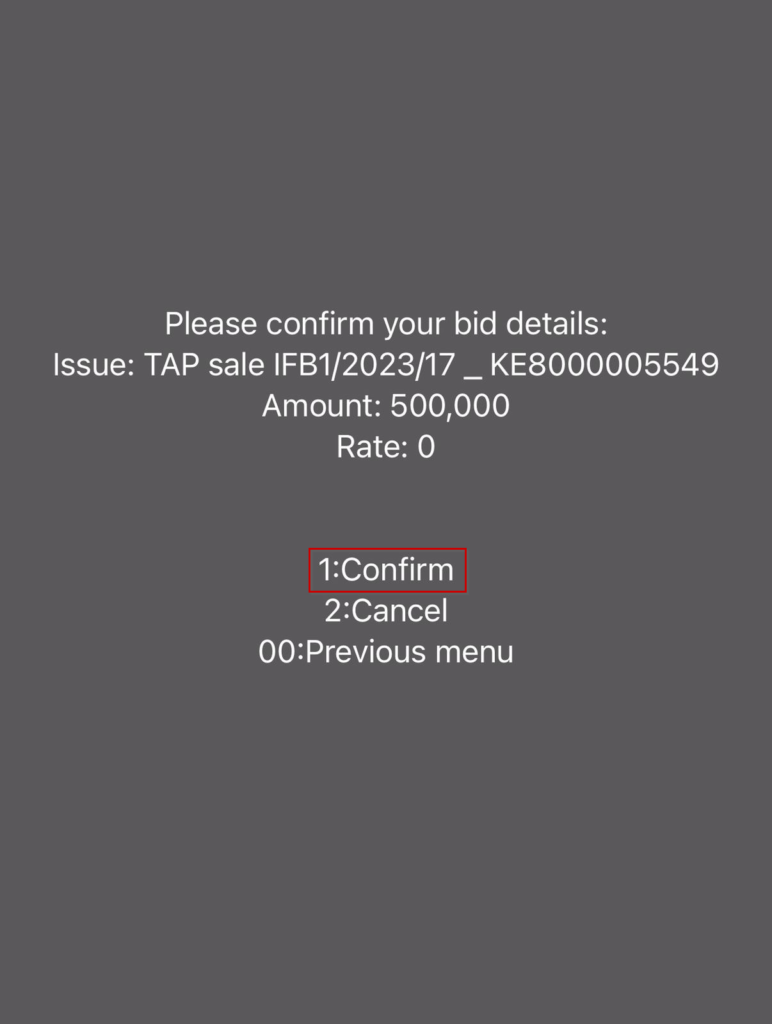

Step 9: Confirm bid details

Step 10: An SMS/Email will be sent to you confirming your bid placement and a final approval will be shared in the next few working days

PS: You may use the RTGS payment method to wire your money to the CBK once your bid is accepted.

How to Buy Government Bonds Through an Investment Bank

While the Dhow CSD option is convenient, it requires you to dedicate lots of time to set up everything. If you are the busy type or perhaps not tech-savvy, buying your treasury bonds through investment banks is equally a feasible option.

Banks offer a myriad of benefits including:

- Convenience

- Can offer investment advice

- Can help you find a buyer in the secondary market when you need to offload

Before we proceed, it is important to clarify that not all banks are investment banks. Quite a number of banks out there don’t offer such services, so it is important to be armed with the right information beforehand. Some examples of investment banks include:

- Equity Investment Bank (Owned by Equity Bank of Kenya)

- NCBA Investment Bank (Owned by NCBA)

- KCB Capital Limited (Owned by KCB Bank Group)

- ABSA Securities Limited (Owned by ABSA Bank formerly Barclays Bank)

- Dyer and Blair

- Standard Investment Bank

- Sterling Securities Limited

- Faida Investment Bank…to mention but a few.

Steps to Acquire Bonds via Investment Banks

The exact process may differ from bank to bank but it is generally something like this.

- You approach an investment bank

- They open a CDS account for you

- You sign the investment agreement documents & provide your ID/Passport, KRA Pin, and Passport photo

- You will be provided with details of a central depository account managed by the bank where you will deposit your funds

- A Statement for Securities will be issued by the CBK once your funds are successfully deposited

- Wait for your coupons every 6 months

Frequently Asked Questions

What is the interest rate of bonds in Kenya?

The rates for government bonds in Kenya vary from one bond to the next. We have seen figures as low as 10% pa to as high as 18% to 20%.

Are treasury bonds a good investment?

If done right, treasury bonds can be a good way to investment. One, however, needs to keep in mind that like any other form of investment, bonds require a long-term strategy and discipline to conquer.

How much can one earn in bonds per year in Kenya?

The returns one gets from bonds vary depending on factors like the amount invested, interest rate, prevailing bond prices, and whether the bond is tax exempt or not.

To put things into perspective, let’s take an example: Juma, invests Ksh1,000,000 in an infrastructure bond (tax-exempt) with an interest rate of 13.5%. Assuming Juma manages to buy the bond at par value* i.e., Ksh100 per bond, his coupons will simply be Ksh135,000 per year. This will be paid in two 6-month instalments of Ksh67,500 each.

On the other hand, Atieno invest Ksh1,000,000 in a fixed interest fixed deposit bond (with a withholding tax – typically 15% of coupons) with an interest rate of 12.5%. Assuming Atieno manages to buy the bond at par value* i.e., Ksh100 per bond, her coupons will be Ksh106,250 per year after WTH tax.

* Bonds can trade above or below the par value of Ksh100. This fluctuation in bond value is attributed to forces of demand & supply along with things like government policy. Fluctuating bond prices could cause volatility and, therefore, one should be sure to consult an investment expert on this matter prior to making an investment in treasury bond.

Conclusion

Investing in treasury bonds in Kenya is a reliable way to preserve your wealth, thanks to the low-risk nature of government-backed securities. However, bonds should be considered a long-term investment vehicle, not a quick path to wealth. While bond prices do experience fluctuations, particularly in the secondary market, this volatility typically poses a significant risk only if the bond is sold before maturity.

In such cases, you might incur a loss if the market value of the bond is lower than the purchase price. To mitigate this risk, it’s advisable to hold bonds until maturity, ensuring the return of your principal along with the promised interest.

Need personalized support on treasury bond investments? Feel free to link up with our mentors for more.

Magdalene is a young Kenyan web content author with a deep love for innovation and finding solutions designed to make the world a better place. The BA Marketing & Comms major at Kisii University boasts strong writing skills thanks to her prior training under the Ajira Digital Program by the Government of Kenya.